Maximally automated AI-native SME lending firm growing through M&A

click here 4 free billion dollar idea!11!1!

This memo was built up from repurposed from internal notes + is very rough! Concrete details have been omitted. The company has been killed.

In a tweet:

AI software as wedge into direct lending –> GBO, consolidation –> holding multiple compounding assets over a long period over time, redeploy playbook in other sectors (constellation in finserve) –> expand the firm & take slice of $4.5T by 2030 private credit sector.

In more detail:

build AI software for non-bank SBA lending firms to automate ~70% of all administrative work – most significantly across origination, closing, and servicing, and also to a lesser priority underwriting, packaging, and front-office. Upon proving GenAI value creation:

Acquire a PLP or SBLC and complete integration of AI to build a maximally automated SBA lender, cutting time to dispersion to 3 weeks and cost per funded loan by ~60% within 9 months.

Buy & integrate multiple SBA portfolios to maximize value captured from secondary sale premiums, which is up to 15x more profitable than the 10% take-rate as a SaaS vendor in lending.

Expand into equipment financing & invoice factoring.

Incorporate a permanent capital vehicle (BDC) to buy loan books from sister lending firms to capture full net interest margin spread and 1/10 mgmt fee incomes at a compounding scale. Become the market maker for small business credit.

Tokenize loan backed assets and offer high yield stablecoins to defi, tapping global capital pools.

The SBA Wedge Today

AI can automate variant knowledge labour. June is a software company whose pride, north star, and 80% of net time input lies in building & delivering excellent products to our customers. We maximally leverage frontier AI across the product offering, incl. voice, unstructured data parsing, agentic automations across originations and portfolio monitoring, automatic report generation and SBA form population, and more. You may view a demo of an older product version here (link removed).

SBA loans (the loan type we are starting with) are infamously paperwork-heavy and labor-intensive. Lenders often take 60 to 90 days to approve and fund an SBA loan. Underwriting a small business loan requires collecting dozens of documents (financial statements, tax returns, business plans), performing eligibility checks, and preparing complex SBA forms – much of which is currently done via email and Excel by teams of processors and underwriters.

High Labor Costs: The cost to originate a small business loan is disproportionately high, due to the variance compared to e.g. real estate. One source reveals an end-to-end SBA lending team (underwriter, processor, closer) that can support ~$10M in loan production costs ~$440K/year. That equates to 4–7% of volume consumed by payroll – e.g. ~$15k in processing cost on a $250k loan. Smaller loans are even more expensive, because the borrower’s business is typically less sophisticated with poorer accounting standards, so more time is required to originate.

Windsor Advantage (top lending service provider, which is basically a BPO that banks purchase to run their entire SBA departments) has 60% of payroll in back-office, specifically servicing.

A top SBA firm (by volume) in Florida has a 3:1 ratio of back-office support staff (underwriting, packaging, closing, and servicing) to production officers (BDOs)

Technology adoption is very low in SME lending, but when adopted, it delivers. Northeast Bank is the fastest growth story in SBA history. They are on track to increase loan volumes from $31M to $1.8B within 3 years (see below). They did this by partnering with Newity, a tech-enabled lending service provider who underwrites small-dollar loans up to $500k. Almost nobody in the industry cares, talks, studies, or tries to learn from this outlier growth story.

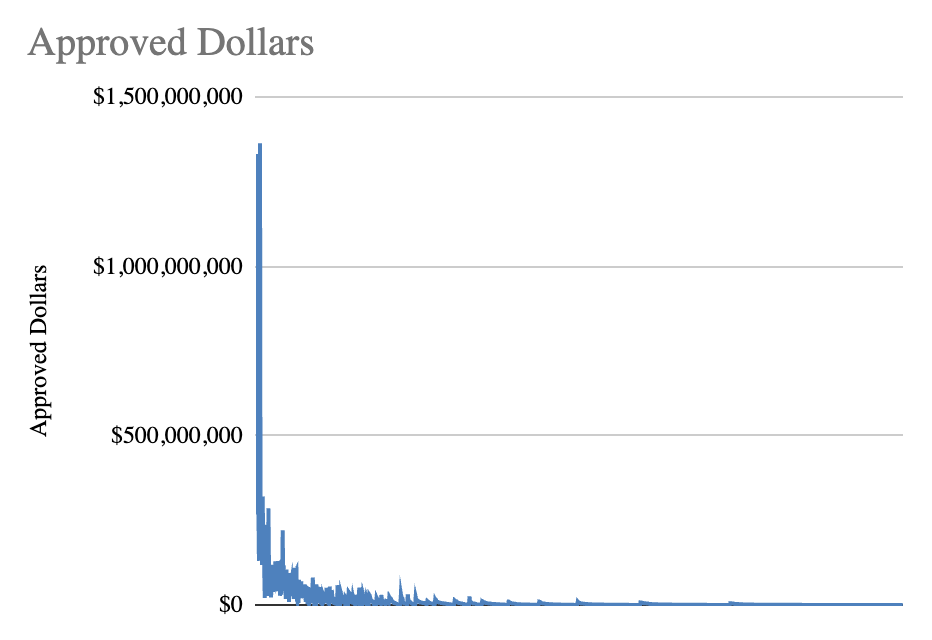

SBA is power law distributed. Only 5 of the several thousand active SBA lenders complete ~70% of all business acquisitions that use SBA financing, and the top 10 firms produce 22% of all SBA volume. There is a massive long-tail of fragmented firms.

SBA is a superstar industry:

Truliant Federal Credit Union moved up 121 spots from 2023 to 2024, now sitting in 38th and producing over $100M in 2025 so far. This leap in the rankings is mostly attributed to a single business development officer: Ray Drew. After increasing margins to levels unforseen in the industry before, we will redeploy that to BDO commission, so we can attract the A-list superstar BDOs that bring in $100M+/y of production (because they bring their client book with them!)

SME Lending: Massive Market, Strong Tailwinds, Huge Opex to Optimize

Private credit is one of the largest industries on Earth. There is $1.3 T of outstanding SME debt alone, and the US SME credit market originates between $400B and $450B of loans per year. Within that, SBA 7a loans reached $31.1B in FY2024 (70,000 loans, avg ~$443k each), and SBA 504 loans added ~$6.6B. The SBA program is growing, is a critical segment for SMEs, and our wedge into broader SME lending. The SBA narrative can be summed as “main street revivalism” – which is very trendy with the New Tech Right and American Dynamism folk.

The addressable OpEx pool associated with originating and servicing these loans is on the order of billions annually. If ~$400B in loans are made and the processing cost is even ~2–3% on average, that’s ~$8–12B in origination/servicing spend each year (>60% of it payroll). In SBA lending specifically, an efficient shop might run at ~4% operating cost of loans, whereas less efficient ones are 7% or higher for small volumes. This suggests $400–500M+ is spent per year in the U.S. just on personnel and overhead to process SBA loans (on $30–40B volume) – a huge pool of cost ready to be converted into margin & profit.

We’ve observed and mapped out the full lifecycle of an SBA loan, and we expect to cut operating costs per loan by 50–60% or more, yielding a similar reduction in headcount. Originations and closing carry the most manual work.

SBA lenders operate at ~10–20% profit margins (some barely break even on smaller volumes). We’ve seen that efficient tech-enabled lenders can hit 35%+ operating margins. In our case, by slashing per-loan labor costs and increasing fee income with faster closings, we project gross margins (net income/total revenue) for the AI-driven lender could reach 40%+. For example, if a bank currently spends 4.15% of loan volume on expenses, we could push that down to ~2%, effectively doubling the profitability of each loan or allowing us to undercut competitors on price (interest rates) while still earning more.

As Baby Boomers seek to exit and pass $7.4T through SME assets, we’ll see a surge in SBA and non-SBA financed M&A activity.

Software Spend Today (~$425M): We estimate ~$425M/year is spent by lenders on software for SME loan origination and servicing – e.g. LOS, doc mgmt, etc. This is a tiny fraction of the total credit volume. It reflects a fragmented tooling landscape and an opportunity for an AI platform to capture value.

Existing software is not good. nCino is one of the most widely used loan origination systems, but users hate it. nCino is de facto a subsidiary of Salesforce, but strategically positioned as an independent company in order to more effectively repackage + resell Salesforce to lenders (!!). nCino’s tech is fully built on SF. They are literally a SF wrapper. From nCino’s S-1:

“If we are unable to renew our agreement with Salesforce, [...] we would be unable to provide our solution to new customers.”

“Cost of subscription revenues primarily consists of fees paid to Salesforce for access to the Salesforce Platform.”

“Salesforce was our second largest stockholder.”

One top 10 (by volume) SBLC spent >$2M and 20 months to implement a Salesforce system that never actually saw widespread internal adoption. BDOs run their own CRM in parallel (Monday, Excel, and other cases).

Invoice factoring is where we’ll expand after SBA. Low regulatory constraints, cheap entry, $151B annual volume across ~900 tiny players, OpEx is ~30% of revenue, AI wedge is collections/on-boarding voicebots & doc parse.

A Large (~$2B valuation) Trade Finance Firm In London That You’ve Probably Never Heard Of (:D) generates the majority of revenues on their trade finance line. Their TF operations are widely considered best-in-industry, according to sources familiar with the matter:

~600 BDOs (£24M/year) doing cold outreach across email and phone.

£2.5M Salesforce cost, with 6 FTE “Salesforce analysts”

Their London office generates 1.7 new clients per dealer per month from 2,480 outbound touchpoints – meaning a 0.06% conversion rate. Worst performing office within the firm.

Primary BDO KPI: 120 mins of calls per day (misaligned incentives – dealers will leave the phone running on empty phone lines to meet this goal.)

It takes a BDO 6 hours to prospect 50 leads.

99% of leads on SF are already in the “assigned” state and cannot be contacted. However, ~70% of SF data is outdated & misleading. Prospecting software is not allowed – some BDOs pay for Endole with personal funds.

Despite these operational failures, the firm is “operationally excellent” compared to the broader industry. We believe executing a ~60% OpEx reduction inside the firm’s BDO function within 12 months by deploying custom AI-powered CCaaS software is plausible. To gain long exposure on this information, one may consider assuming a controlling or activist stake in the firm itself, or entering the market through a competitor firm with a fairer value.

Our Focus: Validate Software ROI, Then Acquire a Lender

In GBO fashion, we want to first prove ROI of our AI software by working with lenders as a vendor, and then leverage the case study to acquire a PLP bank or an SBLC and turn it into a fully automated, AI-powered lender. We operate a highly selective design partnership program, working with only the most progressive founders and CEOs. We are currently engaged in a design partnership with a top 10 firm (by annual loan volume):

We meet BDOs at the firm (one is a top performer that produced ~$50M in FY2024) to break down the full lifecycle of the lending process into discrete steps: first touch, to originations, underwriting, packaging, closing, reporting, disbursement, servicing – with the objective of maximal end-to-end automation.

Here is an old / early version of our product (link removed).

In reality, the optimal path is to buy first without building, because it’s highly plausible and obvious that you can run an SBLC better than a 60 y.o. that doesn’t understand AI, and this is a game of velocity - you need to reach scale ASAP. However, I’ve never met a VC / investor that is courageous enough to take a ~$50M bet like outside of ZIRP. Getting the AI case study is a hoop jumping activity, but it needs to be done

No, the argument “but you need experience to underwrite unsecured cash flow loans like 7a” is nullified by the fact that the founders of Newity are completely green to the industry. They just used tech. Not even AI, just regular CRUD. Lol.

M&A

Why Acquire? (1) full value capture across all revenue opportunities: interest income, secondary premiums, servicing fees, BDC mgmt fees (2) SBLC lending license and out-the-box compliance with invaluable tacit knowledge of SBA SOP. (3) selling software is not an option to capture value; lenders taps out at a tiny outcome, e.g. nCino at $2.7B (4) it’s extremely important to gain market share quickly in an era of high opportunity cost.

There are only 12 active SBLC licenses in the US, making them scarce assets. These include specialist finance companies like Newtek, ReadyCap, etc. Owning a SBLC or small bank gives one the ability to originate SBA loans nationwide with far less regulatory friction (no need to partner with third-party banks as fintechs do). We essentially get the “container” to deploy our AI lending stack at full capacity. There has historically been lots of M&A related to the acquisition of an SBLC license, here’s a recent deal.

Fragmentation: No single bank dominates SBA lending. In FY2024, the top 10 SBA 7(a) lenders accounted for only ~22% of volume. The leader (Live Oak) did ~$1.6B (5% share). This means the remaining ~78% of loans are spread across hundreds of lenders. The market has a very long tail: many small banks each doing a handful of SBA loans. You win by purchasing a large SBLC, and then crushing the long tail through the market – better terms, UX, speed, volume, profitability, and BDO compensation are the key levers. You don’t roll up these community banks with small SBA lines.

Optionality to Launch a BDC & Tokenized Credit Fund

After some time, once our AI-driven lending operation has a stable track record, we can make the first of many expansion moves – create a Business Development Company (BDC), which acts as a permanent capital vehicle as we move upmarket. We could raise, say, a $200M BDC initial fund, which when leveraged could fund several hundred million in loans – accelerating our capital cycle in a compounding positive feedback loop.

This is because – without diluting our main corporate entity – we can capture the credit spread that we give up when we sell the SBA guaranteed loan portions on secondaries. For example, instead of selling the 75% guaranteed piece of 7(a) loans to others for a one-time premium, our BDC could buy & hold those loans, and earn the interest over time. This leads to compounding earnings and asset growth.

Tokenization: we will build a tokenized credit fund to tap massive pools of capital and democratize access to high yield assets. This would allow everyone from any geography to be a fractional owner of our credit fund: massively increasing liquidity and access. You can read Larry Fink’s annual shareholder letter or Fasanara Capital’s blogpost to learn more – here are some of our favourite data points on where this space is going:

MicroStrategy’s core discovery is that the US stock market will pay a 100% premium on Bitcoin. Nobody really knows why.

BDCs often trade at premiums to NAV, e.g. NYSE:MAIN at +68%

Tether generated $14 billion in profit ($93 million per employee) making it one of the most profitable companies in the world. They do this with approximately ~0 cost of capital. The USDT holder is paying an implicit premium of the yield on the underlying government bonds. E.g. if Tether holds a 3-month treasury yielding 5.4%, and you hold USDT, you receive no yield, while Tether pockets the 5.4%. In other words, you’re underwriting the yield as a premium.